```markdown

Shark Tank StepNpull: Unlocking $15M Net Worth Post-COVID Boom

Ever feel a little icky grabbing a public door handle? StepNPull came along and offered a foot-operated solution, and their moment on Shark Tank was just the spark. You might have heard they're raking in millions now, but how much of that is true? We're going to dig into the real story behind StepNPull's rise. We'll look at how they turned a simple idea into a booming business, especially with everyone suddenly caring a lot more about germs. Was it just being in the right place at the right time, or did they do something really smart? We'll break down what worked for them, so you can maybe use some of their tricks in your own ventures. You can also read about business valuation insights.

Step and Pull Net Worth: Unlocking $15M Net Worth Post-COVID Boom

How did a device as simple as a hands-free door opener seemingly achieve monumental success? StepNpull's debut on Shark Tank, coupled with a sudden global awareness of hygiene, raises several questions. Could this basic invention really be worth $15 million, riding the wave of the COVID-19 pandemic? Let's delve into the StepNpull story and its impact on their business valuation.

The Shark Tank Effect and O'Leary's Investment

The entrepreneurs behind StepNpull walked away from the Shark Tank set with a $300,000 investment from Kevin O'Leary, in exchange for 6% of the company. However, the agreement with Mr. Wonderful was more than just about the cash. The presence of the brand on television caused the website traffic and interest of its social handles to skyrocket. It's like giving the company a financial bullhorn, amplifying StepNpull's message to a vast audience, showing that Shark Tank investment can lead to success.

A Simple Solution to Germ Prevention

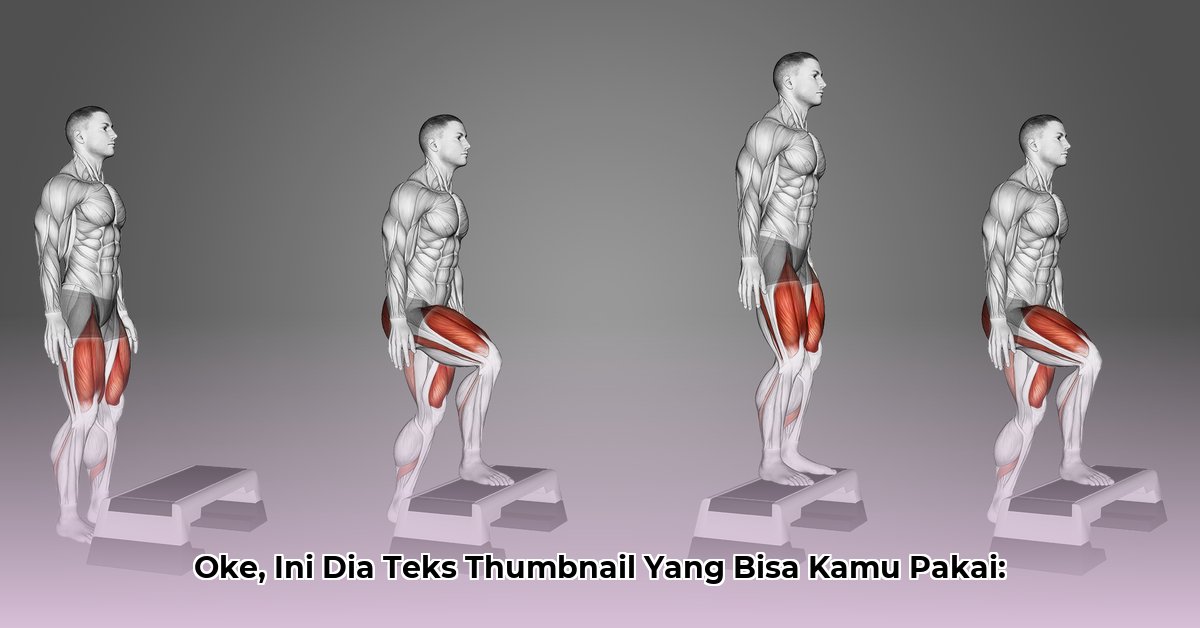

StepNpull offered a simple solution to a universally understood problem. The product addresses a common problem: the desire to avoid touching germy door handles. Picture walking into a public restroom, and instead of having to grab the potentially contaminated handle with your hand, you can easily pull the door open with your foot. Easy! This also shows that ease of use and product design matter.

It shows how easily major companies like Whole Foods, Google, USPS, NASA, and even Ikea added the device into their buildings. They even put the device in their Snapchat headquarters. With a low manufacturing cost of around $7-$9 and a retail price of $29.95, the company has a high gross profit margin. This profitable product strategy demonstrates an affordable health option.

COVID-19: An Unforeseen Catalyst

The COVID-19 pandemic greatly increased the company's potential for growth. As people were more concerned about hygiene and health safety, it increased the demand for StepNpull's touch-free solution. The company's revenue increased to over $1 million per year, proving pandemic-driven revenue was indeed a major source of growth. Did StepNpull take advantage of a global health scare? Possibly. Were they the only company to do so? Probably not. However, StepNpull was well-prepared and at the perfect place in time.

Decoding the Discrepancy: What's the Real Step and Pull Net Worth?

One of the most interesting aspects of the StepNpull story is the net worth, as the predicted totals vary greatly. Shark Tank Insights suggests a net worth of around $6.66 million, based on about 10% in annual growth. But Shark Tank Recap estimates the brand to be worth from $15 to 20 million. Why? What explains this varying net worth estimation then?

The answer lies in the complex nature of valuing a growing business. How do you factor in the potential for future sales? Do you look at profit multiples? Or just ambitious growth projections? There are different ways to arrive at a business's net worth.

Key Factors Contributing to StepNpull's Success

Several elements seemed to have converged to propel the company's success:

- The Shark Tank Effect: As discussed above, being on the show was equivalent to receiving an endorsement from a trusted source, something that cannot be overstated, it provided massive brand recognition.

- Pandemic-Driven Demand: The company was at the right place at the right time. Increase health and safety concerns made an ideal market for the brand, increasing market demand.

- Product Simplicity and Scalability: The concept and product were easy to make and easy to sell. And easy to understand, meaning it was easily manufacturable.

- Strategic Partnerships: Collaborating with major corporations helped amplify the company's presence, showing the importance of strategic alliances.

- Online Sales Channels: The company demonstrated they had a mastery of their marketing campaigns. This, in turn, helped drive sales to several consumers, using effective sales strategies.

Actionable Steps for Entrepreneurs

What lessons can future entrepreneurs learn from StepNpull's story?

- Solve a Real Problem: Find a simple solution to a common frustration. Identifying problems for entrepreneurial solutions matters.

- Embrace Media Exposure: Leverage opportunities like Shark Tank to get recognition. Media Exposure and brand recognition strategies can boost growth.

- Adapt to Market Trends: Stay flexible and capitalize on emerging opportunities, as staying agile allows companies to adapt to changing markets.

- Build Strategic Partnerships: Collaborate to expand your reach and resources, showing the importance of fostering business relationships.

- Scale Production Efficiently: Ensure you can meet demand without sacrificing quality, especially when discussing sustainable business growth.

The Future of StepNpull

What does the future hold for StepNpull and its future product development strategies? Can the brand continue its growth as the pandemic subsides? Their ability to have continued long-term success will depend on ongoing marketing efforts, new product possibilities (such as touch-free restroom solutions), and the ability to expand internationally. Building trusted relationships with facility management companies can also prove to be extremely helpful. How can the business pivot for long-term success?

Potential opportunities and challenges of StepNPull

| Aspect | Opportunity | Challenge |

|---|---|---|

| Product Line | Expanding into other touchless solutions (e.g., restroom fixtures, sanitizing stations). | Maintaining relevance as pandemic-related hygiene concerns subside. |

| Market Expansion | Targeting international markets with high hygiene awareness (e.g., East Asia, Europe). | Competition from similar products and varying building codes/regulations. |

| Partnerships | Collaborating with facility management companies, construction firms, and hygiene product distributors. | Over-reliance on a single distribution channel or partner. |

| Marketing | Leveraging the "Shark Tank" brand and highlighting the long-term cost-effectiveness of the product. | Maintaining brand awareness and generating new leads in a saturated market. |

| Manufacturing | Optimizing production processes to reduce costs and improve efficiency. | Managing supply chain disruptions and fluctuating material costs. |

StepNpull Valuation After Shark Tank: From $5 Million to $15 Million

Key Takeaways:

- StepNpull's post-Shark Tank trajectory illustrates how a combination of strategic investment, heightened hygiene awareness (particularly during the COVID-19 pandemic), and clever partnerships can propel a simple product to substantial financial success. How can businesses maximize external factors for growth?

- Discrepancies in valuation, from the initial Shark Tank pitch to current estimates, underscore the dynamic nature of business valuation and the impact of factors like market conditions and strategic growth on a company's worth. This proves business evaluations are not always straightforward.

- Entrepreneurs can draw valuable lessons from StepNpull's journey, including the importance of identifying niche markets, securing strategic investors, adapting to market trends, and diversifying sales channels. What lessons can entrepreneurs learn from this case study?

The Shark Tank Effect and Kevin O'Leary's Investment

Remember watching Kevin O'Leary strike a deal on Shark Tank? StepNpull's story began there, grabbing $300,000 from Mr. Wonderful himself. This was a pivotal moment. But how did that initial investment shape the stepnpull valuation after shark tank? The show brought instant recognition, a key ingredient for any budding business. It's not just about the money; it's about the spotlight.

Riding the COVID-19 Wave

The pandemic undeniably boosted StepNpull's sales. Did you ever think a simple door opener could become so essential? Heightened hygiene awareness made it a must-have. Revenue soared, and that initial $5 million valuation started looking a little low. The timing was impeccable. It was as if the universe aligned for this nifty product.

Dissecting the Valuation Discrepancy

There's a gap between the initial $5 million valuation and the current $15-20 million range. What gives? It's a testament to the company's growth and strategic moves. Think of it like this: a house initially appraised for $300,000 could be worth much more after renovations and a booming market. Similarly, StepNpull's partnerships with major corporations and